Next story: Seven Days: The Straight Dope From the Week That Was

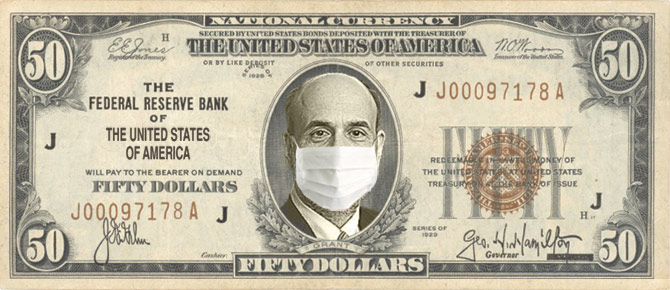

Paging Dr. Bernanke

by Ted P. Schmidt

There's a better way to stimulate the economy than backing up big banks

Big news this week as the Republicans take control of the House of Representatives. On Wednesday, while we were all digesting the poll results, Dr. Ben Bernanke (and the Fed) voted to inject a $500 billion dose of “QE2” shock therapy into the debt-ridden corpse of our economy. In the doctor’s first round of treatment, known as “quantitative easing,” the Federal Reserve bought $1 trillion (yes, that’s trillion!) of defaulted, mortgaged-backed securities in order to save the chosen ones, large commercial banks like Citigroup and JP Morgan. (Goldman Sachs was saved by the AIG bailout.) Basically, the Fed bought mortgages at their full original value, and the banks got risk-free, interest-earning reserves.

Now, in what’s being dubbed QE2, “Helicopter Ben” is trying to resurrect the zombie economy through buying $500 billion dollars worth of long-term treasury bonds from investors, banks, and hedge funds.

There has to be a better way, and there is.

With QE1, the Fed claimed that the $1 trillion injection of “liquidity” was done to unclog the arteries of the banking system and get bank lending going again. In reality, it was done to save the big banks. The Fed “bought” defaulted mortgages, which no longer generated payments to the banks, and replaced them with interest-paying reserves. While the media likes to say the Fed “printed money,” that’s simplifying it too much. Almost all of the $1 trillion created is sitting in an electronic account with the Fed.

Here’s how it works. The Fed tries to control the banking system by requiring that banks hold a “reserve” account equal to 10 percent of demand deposits (i.e. checking accounts). These reserves consist of cash in bank vaults (a very small amount of the total) plus “reserves held on account at the Fed.” The latter is simply an electronic credit held on account at the bankers’ bank, the Fed. The banking system currently has almost $1 trillion in so-called excess reserves sitting in their accounts with the Fed. These represent potential funds that banks can use to make loans, but in the current economy banks choose the safer option of keeping them with the Fed and collecting interest—which is a hell of a lot better than holding mortgage trash that paid them nothing. So, the majority of what the Fed has “printed” is sitting as an electronic chit in accounts at the Fed, and the banks are content to sit on them.

Take note: These funds have no effect on the economy until these too big to fail banks start using them to make loans.

Since QE1 hasn’t worked, Dr. Ben wants to try a radical procedure known as QE2, this time buying long-term treasury bonds from investors in the bond markets. He hopes to accomplish two things: push long-term interest rates even lower; and increase asset prices, like stocks, so people feel richer and more confident, which stimulates them to spend more—at least those people who actually own stocks.

However, there’s a problem, and it’s a big one. Investors are worried that all of this QE medicine is going to cause an adverse reaction in the form of inflation, so they are putting their money into inflation hedges like gold and commodities (wheat, sugar, oil, copper, etc.), or moving funds to other countries whose currencies they expect will rise in value against the dollar (like a Canadian savings account).

Dr. Ben thinks this old-school economic medicine is going to work. But what would you do as an investor knowing Bernanke is going to pump another half trillion dollars into the markets? Probably make more bets on rising inflation—buying more precious metals and commodities—or buy more Canadian dollars to put in your foreign savings account. (QE has caused the dollar to fall against most currencies leading to the so-called “currency wars,” but that’s another story.) Commodity prices have already been rising on speculative bets, and now they will go even higher. The result will be higher prices of wheat, corn, sugar, oil, etc., and very little impact on the US economy. It’s stagflation—high inflation and high unemployment—all over again.

If the goal of this QE medicine is to revive the economic patient, then there is a better way to accomplish it, and Dr. Ben can still help. Many have criticized Obama’s stimulus package for wasteful spending with little impact on jobs. If most people don’t trust government with increased spending, then any new stimulus should focus on cutting taxes. And, that tax cut better be directed at those who will definitely spend it.

Currently, workers and businesses both pay 6.2 percent (12.4 percent total) in Social Security taxes, but the tax only applies to income less than $106,000. That’s an onerous tax on lower- and middle-class workers and small businesses. So a better option than QE2 is a temporary 50 percent cut in Social Security taxes. Based on current Social Security revenues, this would reduce our taxes by a little over $400 billion over the course of a year, which is less than what Bernanke proposes.

The big question: How can we finance this tax cut and maintain current Social Security benefits when the deficit is currently $1.3 trillion? Here’s where the good doctor can help. The Social Security trust fund (there’s a misnomer) has accumulated a surplus of about $2.5 trillion over the past 25 years, because the taxes paid in have been greater than the benefits paid out each year. Unfortunately, every year the government has spent (uh…borrowed) the excess—government treats Social Security taxes just like income taxes, and, in exchange, it gives Social Security, a government agency, an IOU called a treasury bond.

Confusing? Think of it this way. With one hand you save $1 each year in your piggy bank for retirement; with the other, you take it out and buy guns and butter; in exchange, you put in a little piece of paper that says, “IOU $1.” What will you have in that piggy bank after 25 years? Twenty-five dollars worth of IOUs to yourself. You have to pay yourself $25 when you retire!

Government has to pay itself back, and when that bill comes due to cover those IOUs, it will do so by either borrowing more, increasing taxes, or cutting benefits.

So here’s how we finance the $400 billion tax cut on Social Security: If Dr. Ben is going to buy a half trillion dollars worth of government bonds anyway, then why not have the Fed buy them from the Social Security trust fund instead? Rather than hoping investors will use the funds from QE2 to buy stocks, the Fed can buy bonds directly from the SS trust fund, covering the $400 billion decrease in revenues, so we can maintain the current level of benefits.

This solution has more benefits than Dr. Ben’s plan, and less risk: First, it directly benefits those most in need by increasing take-home pay and small business profits, and should directly increase spending; second, households and businesses will decide how to spend the funds, not government; third, it is easily manageable, as you simply reduce the amount taken out of paychecks from 6.2 percent to 3.1 percent, then gradually raise it as the economy recovers; fourth, the Fed won’t have to pay fees to its “dealers” when it buys $500 billion worth of bonds in the “open markets” (now here’s another dirty little secret—guess which large banks get paid by the Fed to facilitate its purchase of $500 billion dollars worth of bonds? Hello, Goldman Sachs!); fifth, it does not raise the gross national debt, because it simply transfers bonds from one government entity (the Social Security trust fund) to a semi-government entity (the Fed); and sixth, it gives the Fed the extra ammo (treasury bonds) it will need when the time comes to restrain inflationary pressures and pull reserves out of the banking system. (It does this by selling bonds to banks.)

The economic patient is in a coma, and Dr. Bernanke wants to try an unproven, radical treatment in QE2. The one thing we know for sure is that the big banks will earn millions of dollars worth of fees acting as the agents for the Fed’s bond sales, and investors will benefit because the increased demand by the Fed will raise bond prices. The impact on economic growth and employment is uncertain, though, because most of these actions do not directly impact spending.

Enough is enough, Dr. Bernanke! It’s time to inject the patient with money that gets into the hands of working people and small businesses.

Dr. Ted P. Schmidt is an associate professor in the Department of Economics and Finance at Buffalo State College.

blog comments powered by Disqus|

Issue Navigation> Issue Index > v9n44 (Week of Thursday, November 4) > Paging Dr. Bernanke This Week's Issue • Artvoice Daily • Artvoice TV • Events Calendar • Classifieds |

Current Issue

Current Issue