Next story: Alex Contino's Paintings at Big Orbit Gallery

After Tuesday, Serious Tax Talk

by Bruce Fisher

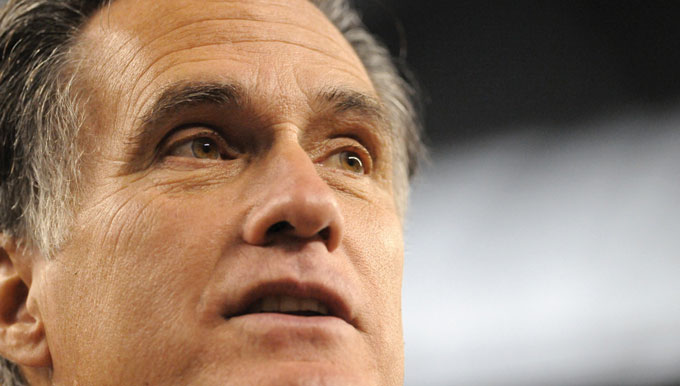

Mitt avoids taxes, but America can’t

Senator Harry Reid was, apparently, not bluffing. Some months ago, Reid asserted that Mitt Romney has not paid income taxes for many years. Romney denied Reid’s claim, but in our politics-as-sports media climate, the Reid statement and the Romney denial were treated like a second-down play in the first quarter. Now, however, as we approach the two-minute warning, an item published by a financial news service that did its own Freedom of Information Act filings with the Internal Revenue Service basically confirms Harry Reid’s story. Bloomberg News revealed that at least as recently as 2007, Romney made use of a now-closed loophole, a form of charitable remainder trust, in order to avoid paying taxes—and to make you and I co-donors to the Mormon Church.

This particular video replay happened just before Hurricane Sandy hit the Jersey shore, meaning that the hurricane displaced most political news, except Romney’s embarrassingly clumsy media-mongering with his canned-food drive. And Reid isn’t very compelling TV anyway, what with calm demeanor and inability to project his voice far beyond his inevitably gray suit. But there is great drama here, because Democratic Senator Reid is a Mormon, and it was he who blew in one of his own kind, just as the Mormon newspaper from the capitol of Mormonism, the Salt Lake Tribune, lacerated Elder Romney in its endorsement of Barack Obama.

Reid used to be dramatic: Some years ago, when a corrupt Las Vegas casino bagman tried to bribe him, Reid set up an FBI sting that nabbed the guy. The lore is that the feds had to restrain Reid from strangling the malefactor in their presence. The man has a temper.

So should we all. Legalized tax avoidance so outraged Americans after Ronald Reagan was re-elected that Republicans and Democrats clambered all over one another to lead the way on tax reform. Reagan signed the historic Tax Reform Act of 1986 because people of every ideological hue were agitated that General Motors paid zero or less than zero in federal taxes while most other companies and individuals had no such deal. Grocery manufacturers and technology firms hated the tax-code goodies that real-estate investors, oil companies, banks, and a favored few conglomerates sniggered about getting. The economists-for-hire who defended the thick tomes of tax laws as necessary for economic growth lost out to a political dynamic that favored intellectual honesty over rented wisdom, mainly because the contrast between “fair” and “unfair” was so stark.

So it is today, what with one presidential candidate hiding assets in pirates’ dens somewhere on the Spanish Main, and the other presidential candidate being, oh, black—which is the only possible explanation for why it is that white folks overwhelmingly poll for the candidate who personifies the globalized financial capitalism and tax favoritism that has beaten down wages, unions, private retirement benefits, and job prospects for tens of millions of angry, nervous, and increasingly agitated Americans.

Worse before better?

Divided government isn’t going to calm anybody’s nerves. On the theory that the Tea Party will control only the Supreme Court and the House of Representatives, and not the White House and the US Senate, too, the government of the United States may still have a chance to act sanely—by working out a deal that will please nobody but which will avert the so-called “fiscal cliff” of massive spending cuts and tax increases beginning with the ball drop as New Year’s Eve ends.

It’s just arithmetic. The wonks at the Congressional Budget Office say a 2013 recession will result from failing to come to some agreement to modify those changes.

But here’s the rub: Unless there are a sufficient number of moderate Democrats like Kathy Hochul who get sent back to Congress, there is a real danger that the Armageddon-loving Tea Party types will be in full psychotic decompensation mode—egged on by insanely irresponsible people, like the signatories of the recent CEO Letter to Congress, who say that our anemic, besieged, low-demand economic recovery will survive cuts in entitlement programs, infrastructure investments, school and science aid, and other federal spending.

The central problem is the arithmetic of the federal debt and of the annual federal budget deficit. Economic recovery has reduced the annual budget deficit by about $200 billion from its recent $1 trillion figure. More tax revenue—which can only be got from higher rates on people with high incomes—will have to be coupled with spending restraint, including restraint on defense spending. Barack Obama has been calling this a “balanced approach.” The Congressional Budget Office uses similar terms.

The trouble is, there may be a majority among the American electorate that believes that taxes in any form, on anybody, even on the investors, speculators, and manipulators who enjoy most of the bennies now, are bad policy, and that the only way to fix the deficit is to cut taxes, not raise them.

What Republicans believe

Rational argument by careful people is not working. Emotional appeals to values, like fairness and equity, are not working. Even appeals to economic self-interest are not working. Only the racialized subtext of Republican rhetoric seems to be working, at least with the majority of white folks. Yet still, a rational analysis of the inherent unfairness of the current tax system surely ought to be politically effective—if only as a goad to resentments.

The new analysis of the capital gains tax preference by veteran tax-fairness advocates Citizens for Tax Justice is such a goad. Once again, we have a colorful graphic that shows just how much more of a deal the one percent get compared to the rest of us. We knew that already. But what it also shows is that the collapse in tax fairness has given us a system that over-rewards speculators compared to anybody who works a job for a paycheck—even a big paycheck. The capital gains tax preference has to go.

Can it? Will it? Well (how liberals hated it when Ronald Reagan said “Well…”), it did once. Ronald Reagan signed off on killing the capital gains tax preference. Reagan signed a law that made capital gains taxable at the same rates as work income. Reagan’s law topped out at a 28 percent capital gains rate. Today, that rate is 15 percent. Reagan’s political people figured out that their own wonks (not their lobbyists or their gun-for-hire economists) had given them a political bonanza when they as Republicans got to be the amplifiers of the fairness message. And along the way, the concept of fairness got somewhat de-racialized.

Today’s Republicans, however, show no signs of going where Reagan went. The trouble now is that Republican rhetoric has convinced Republican voters, and the true believers among the elected officials they are able to elect, that there is no circumstance ever under which raising taxes, or increasing public spending, can be appropriate or supportable—not even when the national debt and the annual current-accounts deficits are as overwhelming as they are today.

Worse, these people believe Reagan’s rhetoric—not his practice, but his rhetoric—that the only way to raise revenues is to cut tax rates.

One cannot debate such people. There is no rational argumentation or chalkboarding or spread-sheeting they will accept. Republican politicians and their consultants gleefully pledge to adhere to economic irrationality in order to get the endorsement and campaign contributions of people who like the rhetoric.

That’s why one must think through the less-than-rosy scenario of an Obama loss and a Mitch McConnell Senate, which would give this country a total Tea Party government led by Paul Ryan’s Tea Party caucus, which already runs the House of Representatives.

Income polarization and economic distress led to the Tea Party opportunity in the first place. Will enhancing returns to investors and speculators address income polarization and economic distress among white males? No, ma’am, they will not. There is zero prospect of a quickly growing economy, according to the Congressional Budget Office, unless there is something like the balanced approach to deficit reduction and revenue-raising that Obama describes. If you believe that Romney and Ryan can unleash stupendously more North American oil production at less than today’s $100-per-barrel price, then you know something that even the most optimistic oil industry shills are not claiming. And if you are the sort of economic analyst who believes there will be far greater job growth without infrastructure investment, plus some restoration of employment among teachers and other public workers, and that it will all come about because American manufacturing is on the rise again, then you are not looking at the same numbers everybody else is—because all the evidence of where household incomes are going these days is pretty consistent, and has been for a long time. It’s not growing for 99 percent of American households. It is growing quite rapidly, however, for one percent of households—the ones that benefit from today’s low capital gains tax rate, a rate that non-taxpayer Mitt Romney pledges to lower even further.

A Tea Party government means no new commitment to green energy, no restraint on galloping price hikes in healthcare, massive federal downloading to state governments, and no intervention in the problem of income polarization. The real danger of Tea Party hegemony is that these politicians do not adequately comprehend that their rhetoric-led policies will exacerbate the economic stress of their angry, sullen, paranoid. Caucasian base. Stressed folks do crazy things. Pots simmer a long time. Sometimes, they boil over.

Bruce Fisher is director of the the Center for Economic and Policy Studies at Buffalo State College. His new book is Borderland: Essays from the US-Canada Divide, available at bookstores or at www.sunypress.edu.

blog comments powered by Disqus|

Issue Navigation> Issue Index > v11n44 (Week of Thursday, November 1) > After Tuesday, Serious Tax Talk This Week's Issue • Artvoice Daily • Artvoice TV • Events Calendar • Classifieds |

Current Issue

Current Issue